Unlocking Growth Potential: Bagley Risk Management Approaches

Wiki Article

Exactly How Animals Risk Protection (LRP) Insurance Can Secure Your Livestock Investment

In the realm of animals financial investments, mitigating threats is vital to guaranteeing financial stability and growth. Animals Threat Security (LRP) insurance policy stands as a trusted guard versus the unforeseeable nature of the marketplace, supplying a strategic technique to securing your properties. By delving into the details of LRP insurance and its diverse advantages, animals manufacturers can strengthen their financial investments with a layer of safety that transcends market variations. As we explore the world of LRP insurance, its role in protecting livestock investments comes to be significantly evident, guaranteeing a course in the direction of lasting economic resilience in a volatile industry.

Understanding Animals Danger Protection (LRP) Insurance Policy

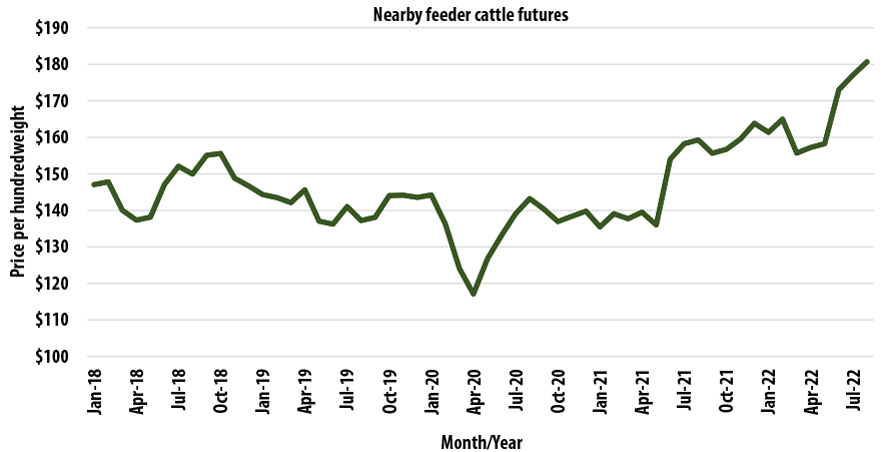

Comprehending Livestock Danger Protection (LRP) Insurance policy is vital for animals producers looking to alleviate financial threats connected with rate changes. LRP is a government subsidized insurance coverage item developed to shield producers versus a decrease in market rates. By offering insurance coverage for market value decreases, LRP aids producers secure a floor cost for their animals, guaranteeing a minimal level of income no matter of market fluctuations.One secret facet of LRP is its flexibility, allowing producers to tailor protection degrees and policy lengths to fit their specific requirements. Manufacturers can pick the number of head, weight range, protection rate, and coverage period that line up with their manufacturing objectives and risk tolerance. Recognizing these customizable options is critical for manufacturers to effectively manage their cost danger direct exposure.

In Addition, LRP is readily available for various livestock types, including cattle, swine, and lamb, making it a flexible danger monitoring device for animals manufacturers throughout various fields. Bagley Risk Management. By acquainting themselves with the details of LRP, manufacturers can make informed choices to safeguard their investments and ensure monetary stability when faced with market uncertainties

Advantages of LRP Insurance Policy for Animals Producers

Livestock manufacturers leveraging Livestock Risk Defense (LRP) Insurance coverage obtain a critical advantage in shielding their financial investments from price volatility and safeguarding a steady financial ground amidst market unpredictabilities. By setting a flooring on the cost of their animals, producers can minimize the danger of substantial monetary losses in the occasion of market recessions.

In Addition, LRP Insurance provides manufacturers with tranquility of mind. On the whole, the advantages of LRP Insurance policy for animals manufacturers are considerable, offering an important tool for taking care of threat and making certain monetary protection in an uncertain market atmosphere.

Exactly How LRP Insurance Mitigates Market Threats

Minimizing market dangers, Livestock Threat Security (LRP) Insurance provides livestock producers with a reputable shield versus cost volatility and financial unpredictabilities. By providing defense versus unanticipated cost drops, LRP Insurance policy assists manufacturers secure their financial investments and preserve economic stability despite market fluctuations. This kind of insurance enables animals producers to secure a rate for their animals at the start of the plan period, making sure click over here now a minimal price level despite market changes.

Actions to Safeguard Your Animals Financial Investment With LRP

In the realm of farming threat management, executing Livestock Danger Security (LRP) Insurance policy involves a tactical procedure to secure financial investments versus market variations and uncertainties. To secure your livestock investment efficiently with LRP, the very first step is to examine the certain dangers your procedure deals with, such as rate volatility or unanticipated climate occasions. Next off, it is essential to research study and pick a respectable insurance policy company that uses LRP plans customized to your animals and organization requirements.Long-Term Financial Protection With LRP Insurance Policy

Ensuring sustaining economic security via the use of Livestock Risk Protection (LRP) Insurance policy is a sensible long-lasting strategy for farming manufacturers. By integrating LRP Insurance into their threat administration plans, farmers can safeguard their livestock investments against unpredicted market top article variations and unfavorable events that can endanger their financial well-being in time.One secret advantage of LRP Insurance coverage for lasting monetary safety is the assurance it provides. With a dependable insurance coverage in position, farmers can minimize the monetary threats related to volatile market conditions and unexpected losses because of factors such as illness outbreaks or all-natural disasters - Bagley Risk Management. This stability permits producers to concentrate on the day-to-day procedures of their animals company without consistent stress over potential monetary setbacks

Furthermore, LRP Insurance policy offers an organized strategy to managing danger over the lengthy term. By setting certain coverage levels and selecting ideal endorsement periods, farmers can customize their insurance policy plans to line up with their economic goals and run the risk of resistance, ensuring a safe and secure and sustainable future for their livestock operations. Finally, buying LRP Insurance is a positive method for farming manufacturers to achieve long lasting monetary safety and shield their livelihoods.

Conclusion

In final thought, Livestock Risk Defense (LRP) Insurance coverage is an important tool for livestock manufacturers to alleviate market risks and secure their financial investments. It is a sensible option for safeguarding livestock financial investments.

Report this wiki page